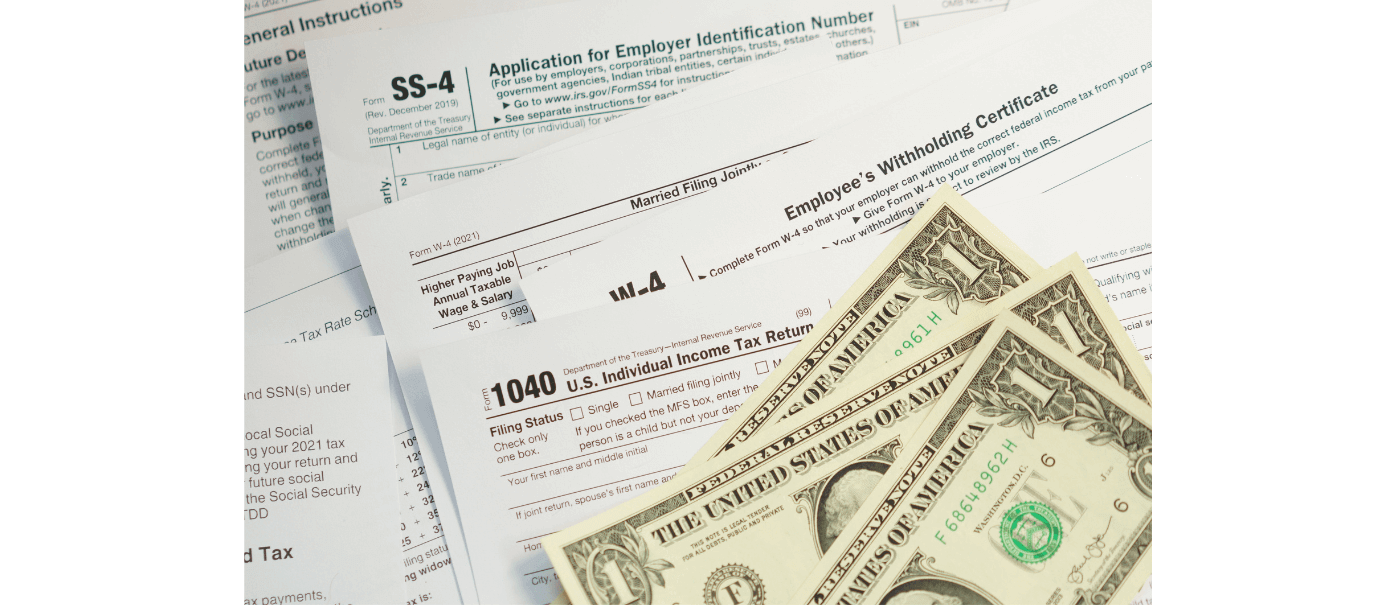

How Different Ages Impact Your Taxes

The tax code isn’t just complicated, it also shifts depending on your age or the age of your dependents. From credits that benefit parents of young children, to penalties or perks for retirees, your age can have a surprising impact ...